Vertiv is a Cool Way to Own AI Infrastructure

By Jim Krapfel, CFA, CFP

June 2, 2025

Background

I started buying Vertiv Holdings (ticker VRT) for client accounts in May 2024 at around $101/share. I increased our position in the company in April 2025 near $83 to optimize clients’ exposure to one of my favorite long-term investment themes – growth of artificial intelligence (AI). Vertiv was the 11th largest position in aggregate across client accounts as of May 31.

Company Introduction

Vertiv designs, manufactures, and services critical digital infrastructure for data centers, communication networks, and commercial and industrial environments. It provides the hardware, software, and services to facilitate an increasingly interconnected marketplace of digital systems where large amounts of data need to be transmitted, analyzed, processed and stored. Specific offerings include AC and DC power management products, switchgear and busbar products, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure.

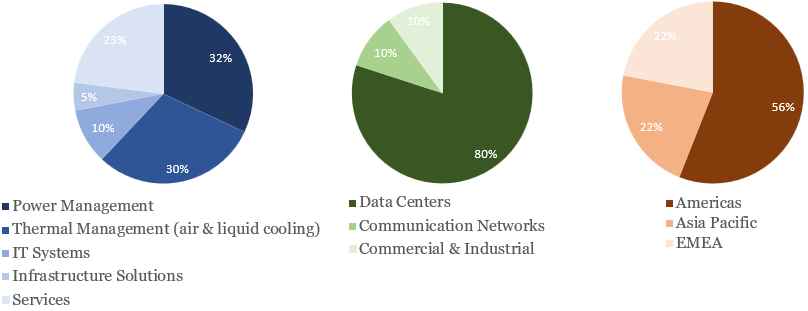

Revenue is broken down by portfolio, end market, and geography below.

Figure 1: Revenue by Portfolio (2023), End Market (2024), and Geography (2024)

Source: Company filings

The company is headquartered in Westerville, Ohio and carries a market capitalization of $41 billion. The company’s roots go back to 1946. It became a separate division of Emerson Electric (ticker EMR) in 2016, then spun off from Emerson in 2020, becoming a standalone publicly traded company through a merger with a special purpose acquisition company (SPAC).

Investment Thesis

We own Vertiv because it is highly leveraged to data center demand growth.

With the rapid proliferation of AI applications, most famously with the ChatGPT chatbot launch in November 2022, global demand for data is skyrocketing. During Nvidia’s (ticker NVDA) first quarter 2026 earnings call, CEO Jensen Huang noted that the latest versions of chatbots require hundreds to thousands times the computing resources of prior AI models because of their ability to reason, or to reflect more thoroughly on a query by performing numerous thought computations to arrive at a higher-quality response. AI applications are moving beyond chatbots to AI agents, which take simple directions and complete multistep computer actions to automate personal and business tasks.

Growing data needs drive demand for AI-ready data centers. In November 2024, Vertiv gave a data center market outlook of 10-13% cumulative average growth rate (CAGR) over the next five years. Many others have since forecasted higher growth rates because capital spending announcements from hyperscalers like Amazon (ticker AMZN), Microsoft (ticker MSFT), and Alphabet (ticker GOOG) indicate even faster rates of spending growth, at least for the next year or two.

There is good reason to believe Vertiv will grow alongside data center spending. First, AI-centric chips in data centers require greater electricity, generating more heat, which requires more sophisticated cooling systems that play into Vertiv’s strengths. Second, the company’s collaboration with industry leaders position the company well. Its most notable collaboration is with Nvidia, in which Vertiv is a Solution Advisor in the Nvidia Partner Network. It co-develops critical power and cooling architectures that are tailored for enterprises’ needs.

Economic Moat

I believe Vertiv has a moderate economic moat, or sustainable competitive advantage, largely because of a fair amount of customer switching costs and intangible assets. Its economic moat ought to help the company profitably defend against new and existing competitors. Still, I do not believe its economic moat is as strong or durable as most other companies we own, so evolving competitive dynamics deserve attention.

Customer switching costs

Vertiv often provides mission-critical infrastructure. Once integrated, its customers are unlikely to switch to a different vendor because of the complexity of migration, risk of downtime or compatibility issues, and its long-term service contracts and custom configurations. For example, a hyperscale data center customer using Vertiv for power and cooling is unlikely to rip and replace due to operational risk.

Intangible assets

Vertiv has also built a strong reputation in thermal and power management. It has built application expertise over decades with end-to-end solutions, global presence, and scale to meet its hyperscale and colocation customer demands. A culture of continual innovation is evident at the firm as it spends a healthy sum (4.4% of revenue in 2024) on engineering, research and development.

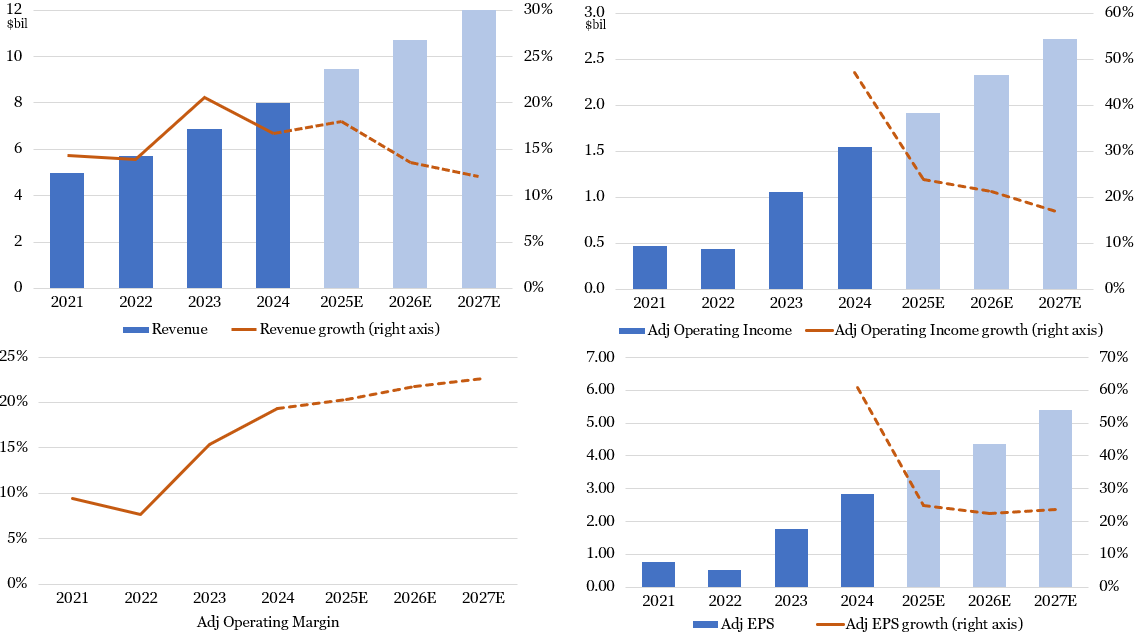

Growth, Profitability & Valuation

Vertiv’s growth metrics should be strong for the foreseeable future. On its first quarter 2025 earnings release in April, Vertiv increased its 2025 revenue guidance to 16.5%-19.5% growth excluding foreign currency (FX) effects from 15-17%. This is consistent with the 17.5% ex-FX growth it produced in 2024. Analysts’ consensus forecasts prudently call for some growth deceleration in 2026 and 2027, but growth could hold in the mid-teens or higher if AI use cases multiply and data center spending continues unabated. Vertiv’s five-year framework, issued in November 2024, calls for 12-14% average annual revenue growth.

Vertiv made huge strides over the past couple of years in raising its margins, first achieving its prior 20%-plus adjusted operating margin target in the third quarter of 2024. Margins were driven by an ability to meet the increasingly complex demands of its data center customers (and align price with value created) and an achievement of better economies of scale. Margins should continue to be stoked by these drivers, but higher tariff-related costs ought to slow its margin expansion somewhat. I expect Vertiv will ultimately exceed its framework that calls for 25% operating margins by 2029.

Over the next five years, I expect low- to mid-teens average revenue growth, one to two percentage points of annual margin expansion, and lower interest expense from debt paydowns to catalyze low 20s percentage average EPS growth.

Figure 2: Vertiv is on a Solid Growth Trajectory

Sources: Company filings (historical results), Koyfin (analysts’ consensus estimates), Glass Lake Wealth Management

Vertiv sports a next 12 months’ (NTM) price to earnings (P/E) multiple of 28.7x versus the S&P 500’s 22.4x. I believe the premium multiple is deserved because of its leverage to such an attractive long-term investment theme. The valuation multiple (and stock price) will likely significantly fluctuate alongside expectations of data center spending.

Key Risks

The biggest risk is that data center spending growth fails to meet high expectations. There are several potential ways this could materialize, including hyperscalers reducing their capital spending plans because of inadequate returns and/or shareholder pressure, advancements in AI fail to create sufficiently strong economic use cases, or a downturn in the economy that causes companies to reduce spending.

There is also risk that Vertiv’s economic moat is not strong enough to protect it from emerging competition, especially in the faster growing liquid cooling portion of Vertiv’s product portfolio that has attracted many new entrants. Further, if a competing provider displaced Vertiv as Nvidia’s trusted partner, the financial impact to Vertiv could be substantial.

Finally, Vertiv could destroy shareholder value if it makes bad acquisitions. With its greatly improved balance sheet and rapidly expanding free cash flow generation, the company has shown increased interest in making acquisitions, but there is always the risk any transaction is not a good strategic fit or is poorly executed.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.