S-Corps Are More Taxing Than Advertised

By Jim Krapfel, CFA, CFP

May 1, 2025

Small business owners have many big decisions to make, and among them is choosing the optimal tax structure. Many tax experts tout the self-employment tax savings that can be realized through S Corporation (S-Corp) elections, but few dig as deep into their additional costs, hassles, and limitations.

In this financial planning blog, I provide a first-hand assessment of the pros and cons of electing to be taxed as an S-Corp. I also ascertain the level of business profitability required to tip the scales in favor of an S-Corp. You will see that it is much higher than what is typically cited.

S-Corp Introduction

A new business owner must choose whether to set the business structure as a sole proprietorship, partnership, Limited Liability Company (LLC), or C Corporation (C-Corp). Many entrepreneurs opt for an LCC structure over a sole proprietorship or partnership because of its liability protections – that is, personal assets of the owners are protected from the business’s debts and liabilities. An LLC is typically preferable over a C-Corp because C-Corps are more complex to set up and face double taxation – that is, once at the corporate level and again when profits are distributed to shareholders as dividends.

Owners of LCCs (as well as C-Corps) also decide whether to stick with the default option of having the business’ income pass through to their personal income taxes, which I will refer to as a disregarded entity, or choose to be taxed as an S-Corp. As we will get into shortly, the primary motivation to elect an S-Corp is to save on self-employment taxes, or Social Security and Medicare taxes.

Note that the S-Corp designation is simply a tax designation for U.S. federal income tax purposes. Opting for an S-Corp does not change the LLC’s business structure unless the owner(s) also wants to change to a C-Corp business structure and be taxed as an S-Corp. The decision to S-Corp can be made at any time by submitting Form 2553 to the IRS, but it must occur within 2 months and 15 days of a new tax year to take effect that year.

When opting to S-Corp, you must pay yourself a “reasonable” salary or risk drawing the ire of the IRS. Exactly what is considered reasonable is not spelled out, but factors to consider are salaries for similar roles in your industry and experience level; amount of work performed, time commitment, and level of responsibility; and business profitability. Any remaining business profit paid out to the owner(s) is called a distribution.

Major Pros and Cons of S-Corps

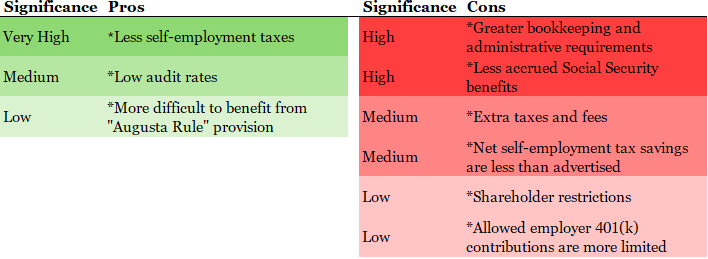

It is critical to understand all that goes into taking on the S-Corp tax filing status. Let us jump into the major considerations in support of and against S-Corps.

Figure 1: Pros and Cons of S-Corps

Source: Glass Lake Wealth Management analysis

Pros

Less self-employment taxes. This is the primary appeal of S-Corps. In addition to being subject to the usual federal and state income taxes, self-employed individuals are responsible for the full 12.4% Social Security tax on up to $176,100 of net earnings and 2.9% Medicare tax on their entire net earnings (15.3% total). When you work for somebody else, the employer covers half that, or 7.65%. A 0.9% additional Medicare tax applies to the worker when net earnings from self-employment exceed $200,000 for single filers or $250,000 for married-filing-jointly filers. S-Corp owners choose what portion of their business profitability will go towards his or her salary. Notably, only the salary component is subject to self-employment taxes (Social Security and Medicare taxes). The distribution component is only subject to ordinary income tax, just like short-term capital gains, unqualified dividends, and interest income.

Low audit rates. Historically, audit rates for S-Corps have averaged around 0.1%, less than the 0.36% audit rate for all personal income tax returns in 2023. S-Corp audit rates reportedly increased in the later years of Biden’s presidency but remained below 0.5%. The Trump administration’s plans to reduce the IRS workforce by up to 40% likely portends audit rates reverting.

More difficult to benefit from “Augusta Rule” provision. The “Augusta Rule” provision allows business owners to rent out their home to their business and exclude that rental income from their gross income when (1) the business owner owns the property as a primary residence or vacation home in the U.S.; (2) it is rented no more than 14 days per year at fair market value; (3) the home is used for legitimate business purposes, such as meetings, events, or recording videos; and (4) thorough documentation supports the rental, such as a written rental agreement, receipts, and a stated business purpose. This effectively allows money to flow from the business to the business owner without triggering taxable income. Technically, any business structure can use the Augusta Rule, but since S-Corps are separate tax entities, it is easier to establish a bona fide rental transaction between the S-Corp and the shareholder (homeowner). For disregarded entities, the risk of audit is higher and success depends more heavily on documentation.

Cons

Greater bookkeeping and administrative requirements. This is a biggie. Below is all the extra legwork that goes into properly administering an S-Corp:

Run payroll. The requirement to pay yourself a salary means you must engage a payroll service. As of 2025, the cheapest QuickBooks plan is $546 annually, plus $6/month/worker.

Increased bookkeeping requirements. S-Corp owners ought to keep more detailed financial records and can choose to do this tedious task themselves or outsource it. The cost of bookkeeping services can vary widely, from $35/month for QuickBook’s Simple Start single-person plan to $2,000+/month for fully outsourced basic bookkeeping tasks.

Additional, business-only tax return. S-Corp owners must file IRS Form 1120-S which brings extra cost and complexity versus running everything through your personal income taxes. As of 2025, doing your business’ taxes yourself through TurboTax’s Online Business Live Assist is $489 for federal and $69 for state. Outsourcing this task to a CPA might run $800 to $2,500 or more depending on business complexity, level of business activity, and number of employees.

Accountable Plan. An S-Corp must operate an accountable plan, or expense reimbursement plan, to properly document and reimburse business expenses paid using personal funds. The reimbursement must be made within 60 days of payment or service date. Common examples of reimbursable expenses are home office expenses (using percentage of home used as your office), the business portion of mixed-use automobiles, and business percentage of cell phone costs. Failing to properly adhere to an accountable plan risks losing the tax deduction for legitimate business expenses.

Annual meetings and kept minutes. S-Corp owners must hold annual meetings and keep minutes of the meetings even when they are the only employee.

Healthcare premium W-2 instructions. S-Corp owners must instruct their payroll service to add the amount of healthcare premiums to “box 1” wages in their W-2 to receive a deduction on their personal return. The S-Corp must also pay or reimburse self for the premiums.

Less accrued Social Security benefits. Paying less into Social Security means receiving less in retirement. More specifically, Social Security benefits are based off the highest 35 years of wage income, adjusted for inflation. The primary insurance amount (PIA) calculation in 2025 entails ultimately receiving 90% of the first $14,712 of annual wages, plus 32% of annual wages between $14,712 and $88,692, and 15% of annual wages between $88,692 and $176,100. There are also possible negative implications for a spouse’s Social Security benefits when taking a spousal benefit or survivor benefit might otherwise make prove advantageous.

Extra taxes and fees. There are a couple of additional costs S-Corp owners must bear:

Payment of federal and state unemployment taxes. The Federal Unemployment Tax Act (FUTA) compels S-Corps to pay a 6% tax on first $7,000 of wages per employee annually, or $420. State laws vary but in my home state of North Carolina, S-Corps must pay a 1% tax on the first $32,600 of wages per employee annually, or $326.

Extra taxes or franchise fees. Some states have extra taxes or franchise fees on S-Corps. For example, California has a minimum annual franchise tax and an additional 1.5% tax on S-Corp net income. New York and Tennessee don’t recognize the S-Corp election and therefore tax the corporation itself. Tennessee goes so far as to require businesses with over $100,000 of sales to pay business taxes despite operating as a tax-free personal income state. Others, like Illinois, Minnesota, and New Jersey, have additional taxes specific to S-Corps.

Net self-employment tax savings are less than advertised. It is not well understood that LLC owners who do not elect to be taxed as an S-Corp can deduct 50% of their self-employment taxes on their individual tax return. So, if business profits total $100,000 and they pay 15.3% or $15,300 of Social Security and Medicare taxes, half this, or $7,650, counts as a deduction. This amounts to 1.7% lower net payment of self-employment taxes for someone in the 22% marginal tax bracket. Therefore, the oft-cited 15.3% self-employment tax savings for S-Corps may net out to 13.6% when accounting for this deduction.

Shareholder restrictions. There are several requirements unique to S-Corps, such as (1) a limitation to 100 shareholders; (2) all shareholders must be U.S. citizens or residents with certain trusts and estates allowed but not partnerships or corporations; and (3) there can only be one class of stock with profit distributions proportional to ownership. Therefore, an S-Corp may not be a great option for businesses planning to seek venture capital or a complex ownership structure.

Allowed employer 401(k) contributions are more limited. For disregarded entities, tax-deductible employer 401(k) contributions are allowed up to 20% of earned income. Earned income is defined as net earnings (business profits) minus ½ of self-employment tax minus the employer contribution itself. For S-Corps, employer 401(k) contributions are limited to 25% of salary. Because salaries are usually set considerably less than business profits (to save on self-employment taxes), owners of S-corps cannot contribute as much to the employer portion of their 401(k). Allowed employee 401(k) contributions are the same for both.

Business Profitability Threshold for S-Corp Decision

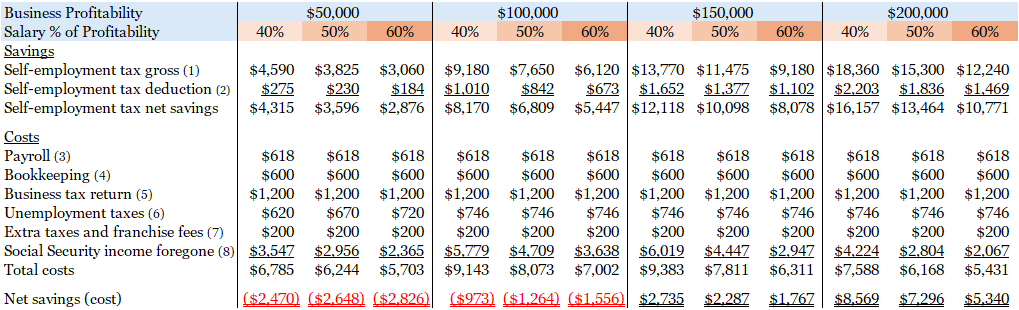

As you can see, there is much to account for when assessing the merits of pursuing S-Corp taxation. Now, let us investigate how these factors might determine a business profitability level where it makes sense to pursue S-Corp taxation. If you ask ChatGPT “at what level of business profitability does it make sense for an LLC to be taxed as an S-Corp?”, it will answer with “when net annual profits consistently exceed ~$40,000 to $50,000.” However, I come to a much different conclusion when running through four business profitability scenarios with three salary assumptions for each.

Figure 2: Estimating S-Corp Net Savings Across Incomes and Salaries

Source: Glass Lake Wealth Management analysis

Notes: (1) 15.3% saved on self-employment taxes; (2) assumes marginal tax rates of 12%, 22%, 24%, and 24% across the business profitability scenarios; (3) assumes QuickBook’s cheapest plan for 1 employee; (4) assumes near low end of typical range; (5) assumes mid-priced accountant is hired to prepare return; (6) reflects Federal and North Carolina provisions; (7) reflects North Carolina franchise tax; (8) reflects lifetime SS income lost per year of paying yourself a lower salary and assumes (a) applicable primary insurance amounts (PIA), (b) Social Security benefits first claimed at full-retirement age of 67 and used for 18 years, (c) 85% of benefits taxed at applicable marginal tax rates, (d) 20% benefit reduction to reflect Social Security funding concerns

Based on my analysis and with these assumptions, quantifiable savings do not accrue until business profitability reaches a much higher level of around $110,000-$125,000. The salary you pay yourself, the extent to which you outsource administrative tasks, and the state you operate in drive the greatest variability.

What no other published analysis seems to account for is the foregone Social Security income in your retirement years. You take a sizeable hit to accrued Social Security benefits for every dollar of salary paid to yourself below the 15% bend point, which is $88,692 in 2025. Only when having at least 35 years of higher wage income does this effect become moot.

The S-Corp decision comes down to more than dollars and cents. You still have all the upfront and ongoing administrative time and hassle to factor in, not to mention the shareholder restrictions that are relevant for some. Taking everything into account, I believe the true break-even point for the decision to S-Corp lies somewhere in the $140,000 to $170,000 range of business profitability for most people.

Bottom Line

An oversimplified analysis of S-Corp tax savings can lead a business owner to seek S-Corp tax status too early in the business profitability ramp. There are considerable offsets to the self-employment tax savings that may initially go undetected, notably the lower Social Security benefits that accrue. Most business owners are better off waiting to elect S-Corp tax status until business profits reliably exceed $150,000.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, tax, legal, insurance nor accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.