July 2025 Investment Letter

July 2, 2025

The second quarter was one of the most eventful quarters for market participants in recent memory. There were dramatic tariff announcements, a highly public fallout between President Trump and Elon Musk, the U.S. dropping bombs on Iran, and a gathering momentum towards a big tax bill. We knew there was going to be a lot of activity with this Trump presidency, but this quarter was certainly a whirlwind.

Tariffs were certainly at the fore. The stock market’s already anxious feelings towards tariffs entering the second quarter turned to panic when President Trump announced his sweeping, country-specific tariffs on April 2, a day he refers to as “Liberation Day” but can be better described as “Liquidation Day.” The dramatically higher-than-expected tariffs were widely panned by economists, and the S&P 500 (SPY) tanked 10.5% over the following two days, extending its decline from February 19th highs to 19%.

However, the stock market quickly started rebounding when signs emerged that the announced tariffs were merely an opening salvo in an ongoing negotiation with other countries and that Trump was not actually willing to tank the economy. Implemented tariffs, while significant, have been less severe than threatened thus far as Trump and his trade team continue their negotiations. The following tariffs are currently in effect: 10% baseline universally, 50% on steel and aluminum (except for the UK), 25% on automobiles and parts (excluding USMCA-compliant goods), 30%+ on China, and 25% on countries that purchase Venezuelan oil.

As worst-case tariff scenario concerns eased, investors looked to how the economy and company earnings were holding up amid the chaos. Consumer spending, about 70% of the U.S. economy, has clearly slowed. In May, real (inflation-adjusted) consumer spending on goods fell 0.1% month-over-month, marketing the first decline since January. Spending on durable goods, especially vehicles, dropped sharply as consumers front-loaded purchases in prior months ahead of expected tariffs. Meanwhile, real spending on services edged up just 0.1% in May, the smallest monthly gain since November 2020.

However, labor markets continue to be resilient. Nonfarm payrolls expanded at a moderate pace through May, and the unemployment rate has held steady at 4.2% over the past several months. There are signs that labor markets could weaken somewhat going forward, but if initial unemployment claims do not spike and people are generally not fearful of losing their jobs, any further weakness in consumer spending ought to be contained.

Company earnings results continue to be robust in aggregate. S&P 500 earnings for the first quarter (reported in April and May) rose 10%, exceeding analyst expectations. Guidance for second quarter and full year earnings was mixed, with technology companies showing strong optimism and those in energy and consumer discretionary generally citing cost pressures and weaker demand.

Strong company earnings, as well as renewed investor enthusiasm for artificial intelligence (AI), allowed stock markets to make new highs before quarter end. In fact, it was the sharpest recovery ever in terms of how quickly the S&P 500 was able to make new highs after declining at least 15%. All told, the S&P 500 rose 10.6% in the quarter, putting its first half performance at +6.1%. By comparison, the Russell Mid-Cap ETF (IWR) gained 8.4% and 4.7% and the Russell 2000 small cap ETF (IWM) rose 8.5% and declined 1.9%, respectively.

Figure 1: Stock Markets Staged a Strong, V-Shaped Recovery

Source: Koyfin (inclusive of dividends)

AI Theme Reestablishes Itself

Perhaps the most bullish development in the second quarter was signs that AI spending will continue apace. All the big cloud players – think Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOG), Meta Platforms (META), and Oracle (ORCL) – reaffirmed or increased their commitment to spend dramatically more on AI/data center infrastructure this year with no hints spending will abate into 2026. Earlier there were concerns 2025 could mark a cyclical peak in AI capital spending.

In June, Bank of America published a bullish forecast of AI data center spending. They expect AI data center spending to increase from $250 billion today to $820 billion in 2030, a compounded annual growth rate (CAGR) of 26%, far outpacing overall IT spending at 8% CAGR. If this plays out, many of the companies in our portfolio should directly benefit, including those who supply the chips into the data center, those who rent out computing power, storage, and networking capacity from the data center, those who cool the data center, and those who supply the electric infrastructure into and within the data center.

Over time, implementation of AI capabilities that keep rapidly improving ought to bring significant efficiencies to a wide swath of companies. Prospects for higher earnings in the future augur for higher stock prices today. Further, whenever there are major productivity-enhancing technological breakthroughs, the economy can grow faster without spurring inflation. So, if the promise of AI comes true, inflation can remain well-contained despite tariff impacts, intermediate- and long-term U.S. Treasury yields can be contained despite widening budget deficits, and stock valuations can rise.

Market Outlook

Despite a calmer environment, the stock market still faces elevated uncertainty. The ultimate fate of Trump’s threatened tariffs remains unknown, with just one deal reached with a trading partner to which the U.S. operates a trade deficit (deal with Vietnam announced today). If the economy and stock market continue to hold up, Trump may feel emboldened to push tariffs harder, putting markets in retreat again, even if temporarily.

Also, the stock market assumes the “Big Beautiful Bill” reaches the finish line. Yesterday the Senate passed their version of the tax bill and the House either needs to sign off on that (as early as today) or work out their differences with the Senate in the coming days and weeks. In the unlikely event some version of the bill is not ultimately passed this year, the stock market would likely take a hit because personal tax rates would reset significantly higher in 2026, putting incremental pressure on the consumer.

The other key variable for the market is upcoming inflation figures and what that means for the Federal Reserve’s willingness to resume cutting its Fed Funds rate. Recent inflation figures have been tame despite tariffs, likely owing to pre-tariff inventory stockpiling and falling energy prices. If inflation reaccelerates, then expectations the Fed will soon lower rates will be dashed, and the stock market could suffer. If inflation remains well contained, then the Fed will get the green light to cut rates in the second half of this year, potentially propelling stock markets upward.

Bond markets are confident the Fed will soon be cutting. According to the CME FedWatch Tool, as of July 1:

there is a 19% probability of a 25 basis point rate cut to 4.00-4.25% at the July FOMC meeting

there is a 92% probability of a 25 basis point rate cut to 4.00-4.25% at the September FOMC meeting

there is a 68% probability of a 25 basis point rate cut to 3.75-4.00% at the October FOMC meeting

there is a 54% probability of a 25 basis point rate cut to 3.50-3.75% at the December FOMC meeting

Figure 2: Inflation and Treasury Yields are Edging Lower

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System. https://fred.stlouisfed.org/series/DGS10 (10-year US Treasury yield), https://fred.stlouisfed.org/series/PCEPI (PCE inflation all items), https://fred.stlouisfed.org/series/PCEPILFE (PCE inflation ex-food & energy). Forbes Advisor. https://www.forbes.com/advisor/investing/fed-funds-rate-history/ (Fed Funds rate).

No matter the economic, monetary, political, or geopolitical environment, it is best to not try to time the market and stay true to a long-term asset allocation that makes sense given your return objective, risk tolerance, and time horizon. I hammer home this message in every investment letter. The message proved prescient this past quarter when market fears ran high and even I was feeling glum. Sometimes you must look beyond the scary headlines and know that better days are ahead. In this case, the wait for better days was historically brief.

Client Positioning

I take a long-term view that focuses on compounding returns in a tax-efficient manner. I allocate the bulk of my clients’ equity exposure to “quality growth” companies that possess durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. I generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate my investment thesis and retaining stocks of companies with solid fundamentals. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

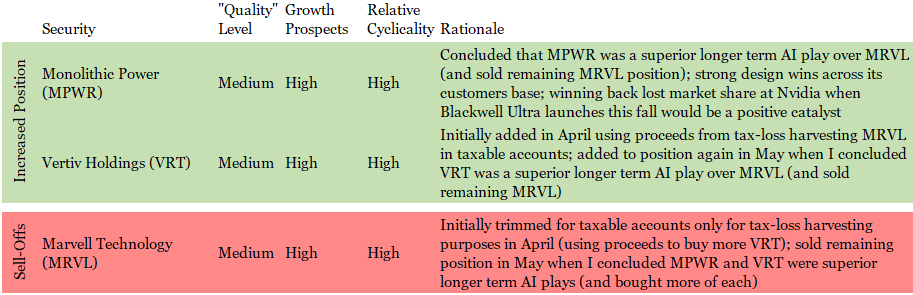

Portfolio activity was light in the second quarter. The biggest change was a repositioning within the AI theme. I initially sold Marvell in April in clients’ taxable accounts only for tax loss harvesting purposes. Before it was time to buy back the stock 30 days later (to avoid triggering a wash sale), I concluded that Monolithic Power (MPWR) and Vertiv (VRT) were better positioned over the next several years and sold off the remaining Marvell shares to buy more shares of Monolithic and Vertiv. As a reminder, last month’s blog featured a bullish write-up of Vertiv.

Figure 3: Portfolio Changes in Majority of Client Accounts in 2Q 2025

Source: Glass Lake Wealth Management

As bullish as I am on the long-term tailwinds for AI infrastructure companies, I know there will be cyclical downdrafts and sometimes stocks get too far ahead of fundamentals. With respect to Nvidia, I have upwardly adjusted the price at which I want to start trimming our position to $165/share from $150/share because of the strong fundamental momentum (despite the China chip sales ban) and the stock finally breaking out to new highs above $150 (now ~$157). If the other stocks in the space become too extended, I will not hesitate in taking some profits there as well, especially in clients’ retirement accounts where there is no tax impact.

As always, you can expect me to abstain from stocks in long-term challenged industries, such as those in traditional energy, airlines, and autos. I will also continue to avoid the most speculative areas of the market such as unprofitable “story” stocks, recent special purpose acquisition companies (SPACs) and pump-and-dump meme stocks.

For clients’ fixed income portfolios, I continue to overweight low duration holdings (duration is a measure of a bond price’s sensitivity to changes in interest rates). I do not believe long-term yields adequately reflect the fiscal situation in the United States. If long-term yields rise, then long-term bonds’ total returns would suffer because bond prices fall when yields rise.

Overall asset allocation is likely to remain near current levels unless there is a big move in either direction in the stock or bond markets. I seek to take advantage of any big stock market correction by increasing clients’ stock exposure if the ability and willingness to take more risk is there. On the flipside, if the stock market is feeling especially frothy and bond yields look relatively attractive, I may look to increase client’s fixed income allocation.

I wish you a wonderful 4th of July holiday weekend and a happy, healthy, and wealthy summer!

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.