Who Wins and Loses from the One Big Beautiful Bill Act

By Jim Krapfel, CFA, CFP

August 4, 2025

On July 4, 2025, President Trump signed into law the highly anticipated “One Big Beautiful Bill Act” (OBBBA). The bill is certainly big on tax policy, most notably with respect to making permanent key elements of the individual tax cuts from the 2017-passed Tax Cuts and Jobs Act (TCJA) that were set to expire in 2026. There are numerous other tax and spending provisions in the bill that have far reaching impacts on individuals and families.

In this financial planning blog, I identify key winners and losers based on specific provisions signed into law, irrespective of one’s political views. Depending on your situation, the net financial impact of the OBBBA could be significant.

Winners and Losers

My analysis is focused on how the bill affects people and not corporations nor institutions. Things that are not in the bill, such as tariffs, are not considered here. For each provision noted and where applicable, I specify the effective date, whether it is temporary or permanent, income phaseout ranges for single and married filing jointly (MFJ) filers, and whether inflationary escalators are included. Referenced income is modified adjusted gross income (MAGI), which is the same as adjusted gross income (AGI; line 11 of Form 1040) for almost everyone.

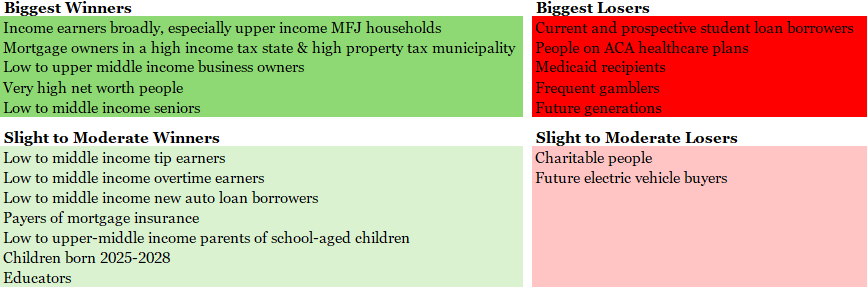

There are distinct winners and losers from the bill. Broadly speaking, upper income workers, homeowners, the wealthy, and seniors fare the best; and low earners, student loan borrowers, working-age adults not covered by an employer healthcare plan, and future generations fare the worst.

Figure 1: Calling Out the Winners and Losers of the OBBBA

Source: Glass Lake Wealth Management analysis

Biggest Winners #1: Income earners broadly, especially upper income MFJ households

Provision: Made permanent the lower tax brackets from the TCJA of 2017

Parameters: Effective in 2026; permanent; tax brackets noted in table below; indexed to inflation

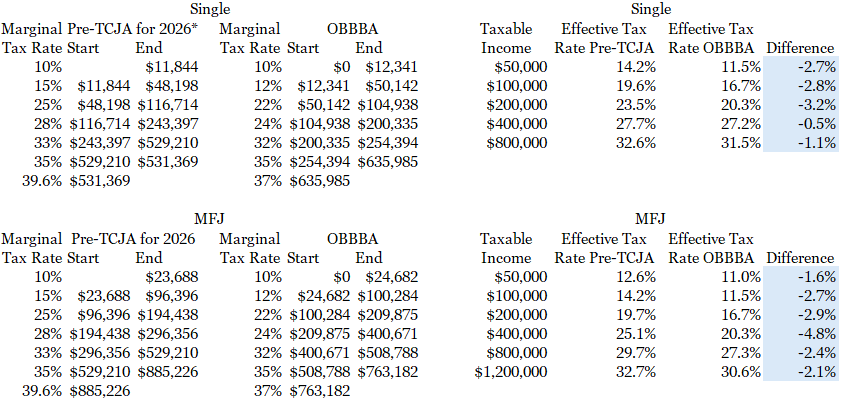

Analysis: This is the most impactful piece of the OBBBA, especially relative to what tax rates were scheduled to revert to if no new tax legislation was passed. Below are the projected tax brackets with OBBBA passage versus what I estimate it would have been if Congress did nothing. The analysis considers the tax brackets in isolation and does not consider the various tax deduction and credit differences between the two tax systems that determine taxable income (and ultimately taxes due).

Figure 2: Tax Brackets in 2026 Will Be Much Lower than They Otherwise Would Have Been

Sources: Glass Lake Wealth Management (calculated 2026 tax rates using pre-TCJA methodology), Kitces (estimated 2026 tax rates using OBBBA methodology). https://www.kitces.com/blog/obbba-one-big-beautiful-bill-act-tax-planning-salt-cap-senior-deduction-qbi-deduction-tax-cut-and-jobs-act-tcja-amt-trump-accounts/?utm_source=chatgpt.com

*My estimate for pre-TCJA methodology is based on cumulative chained CPI-U inflation from September 2017 through June 2025

If you look closely, you can see how for single people, the OBBBA is most beneficial to those with taxable income under $200,335. By contrast, for MFJ households, the OBBBA is most beneficial to those earning $96,396-$400,671. The better treatment for upper income married people stems from the OBBBA extending the TCJA provision that effectively eliminated the steep marriage penalty for households earning under $763,182 in 2026 dollars.

Biggest Winners #2: Mortgage owners in a high-income tax state & higher property tax municipality

Provision: Raises the state and local tax (SALT) deductibility limit to $40,000 from $10,000

Parameters: Effective in 2025; reverts to $10,000 limit in 2030; phases out at $500,000-$600,000 of MAGI for single filers and MFJ; deduction and income limits increase by 1% per year through 2029

Analysis: This is another biggie. The prior $10,000 SALT limit made it difficult for many filers to accumulate enough itemized deductions to overtake the standard deduction, which was $14,600 (single) and $29,200 (MFJ) in 2024. In fact, only around 10% of all filers have itemized their deductions since the TCJA went into effect in 2018 (the TCJA doubled the standard deduction and capped SALT deductions to $10,000 from unlimited previously), versus 31% who itemized in 2017.

Mortgage interest, city and state income taxes, and property taxes are big sources of itemized deductions, so those who have a lot of all three will benefit the most from this provision, at least for the next four years. A noteworthy mention is that the mortgage interest deduction retains its limit of the first $750,000 of mortgage debt for single and MFJ filers.

Biggest Winners #3: Low to upper middle income business owners

Provision: Section 199A Qualified Business Income (QBI) deduction made permanent for pass-through businesses (sole proprietorships, partnerships, S-corps), allowing for deduction of 20% of QBI and 20% of qualified REIT dividends

Parameters: Will continue to be in effect (was set to expire at end of 2025); permanent; phases out to $0 deduction for Specified Service Trade or Business (SSTB) owners (such as those in health, law, accounting, consulting, financial services) at $197,300-$272,300 of MAGI for single filers and $394,600-$544,600 of MAGI for MFJ; phases down to 10% deduction for non-SSTB-owners at same income thresholds; phaseout ranges indexed to inflation

Analysis: This is a valuable deduction for small business owners that was set to expire at the end of 2025. The idea behind the deduction is to put taxability of small business profits more in line with corporations which enjoy a flat 21% tax rate (which was reduced from 28% in the TCJA and made permanent then).

Biggest Winners #4: Very high net worth people

Provision: Made permanent the higher gift tax exemption

Parameters: Gift tax exemption will increase to $15 million for single filers and $30 million for MFJ from $13.99 million and $27.98 million, respectively, in 2025, rather than reverting to ~$7.14 million and ~$14.28 million in 2026 (gift tax rate above these exemptions is 40%); permanent; estate exemptions indexed to inflation

Analysis: Those who are concerned that their beneficiaries could face the hefty estate tax because of their substantial net worth received significant relief. There is less need for advanced estate planning strategies except for those who expect to have a net worth above the new estate thresholds.

Biggest Winners #5: Low to middle income seniors

Provision: Additional $6,000 deduction for each person 65 or older

Parameters: Effective in 2025 through 2028 only; phases out at $75,000-$175,000 of MAGI for single filers and $150,000-$250,000 of MAGI for MFJ; deduction not indexed to inflation but income thresholds are; do not have to itemize to get tax deduction but deduction has no impact on calculated AGI (so taxability thresholds on items such as Social Security benefits are unaffected)

Analysis: Although pitched as “no tax on Social Security,” this provision applies to any income source for those who are least 65 years old (no impact to those younger than 65 collecting Social Security). This important deduction is short-lived unless extended by Congress prior to expiration.

Slight to Moderate Winners #1: Tip earners

Provision: Additional deduction of up to $25,000 for tip earners

Parameters: Effective in 2025 through 2028 only; phases out at $150,000-$400,000 of MAGI for single filers and $300,000-$550,000 of MAGI for MFJ; deduction limited to $25,000 for single or MFJ and limited to net business income and other conditions; deduction not indexed to inflation but phaseout ranges are; do not have to itemize to receive tax deduction but deduction has no impact on calculated AGI

Analysis: Although this is a meaningful deduction, it is limited in practice by only being in effect for four years (unless extended) and an estimation that 55% of tip income goes unreported to the IRS.

Slight to Moderate Winners #2: Overtime earners

Provision: Additional deduction of up to $25,000 for overtime earners

Parameters: Effective in 2025 through 2028 only; phases out at $150,000-$400,000 of MAGI for single filers and $300,000-$550,000 of MAGI for MFJ; deduction limited to $12,500 for single filers and $25,000 for MFJ; deduction not indexed to inflation but phaseout ranges are; do not have to itemize to receive tax deduction but deduction has no impact on calculated AGI

Analysis: This is structured nearly identically to tip earners except single filers receive half the deduction. This provision could be moved to the “biggest winners” category for those who have a lot of overtime income.

Slight to Moderate Winners #3: Low to middle income new auto loan borrowers

Provision: Up to $10,000 of interest is deductible on qualifying auto loans

Parameters: Effective in 2025 through 2028 only; phases out at $100,000-$149,000 of MAGI for single filers and $200,000-$249,000 of MAGI for MFJ; deduction not indexed to inflation but phaseout ranges are; do not have to itemize to receive tax deduction but deduction has no impact on calculated AGI; vehicle must be for personal use, new (not used), assembled in the US, and for new loans taken after 12/31/24 (refinancings qualify if loan balance does not increase)

Analysis: Most people who have auto loans are paying less than $3,000 of interest annually, so the tax savings on this provision are more muted. Click here to learn how to identify if a particular vehicle was assembled in the US.

Slight to Moderate Winners #4: Payers of mortgage insurance

Provision: Restored deductibility of mortgage insurance premiums

Parameters: Effective in 2026; permanent; must itemize to receive tax deduction

Analysis: People who have mortgage insurance, typically those who owe more than 80% of their home’s value in mortgage debt, will be able to claim a deduction for the first time since 2021.

Slight to Moderate Winners #5: Low to upper-middle income parents of school-aged children

Provision: Made permanent increased child tax credits

Parameters: Child tax credit increases by $200 to $2,200 per child (16 or younger on December 31st of tax year) effective for 2025; permanent (had been set to decrease to $1,000 in 2026); phases out at $200,000-$243,000 of MAGI for single filers and $400,000-$443,000 of MAGI for MFJ; credit is indexed to inflation but phaseout ranges are not

Analysis: This makes permanent the doubling of the child tax credit that was set to expire at the end of the year, as well as introducing annual inflation adjustments to the credit amount.

Slight to Moderate Winners #6: Children born 2025-2028

Provision: The federal government will make a one-time deposit of $1,000 into a new “Trump account” for babies born in 2025-2028

Parameters: Effective in 2025-2028 only; no earned income is required and not subject to income phaseouts; baby must be a US citizen

Analysis: It is unclear how the mechanics of the program will work, such as who opens the account, where the account is opened, and when the government contribution will be made. Beyond the government contribution, anyone can fund up to $5,000 per year (indexed to inflation) to the account from the beneficiary’s birth until the year before the beneficiary turns 18. However, certain rules of these accounts, which I won’t go into detail here, make these accounts unattractive to actually contribute to.

Slight to Moderate Winners #7: Educators

Provision: Educator deduction limits for out-of-pocket educational materials lifted

Parameters: Effective 2026; permanent; educator (teachers, coaches, other educators) deductions for out-of-pocket costs of educational materials will be uncapped versus limited to $300 for single filers and $600 for MFJ under current law; no income phaseout ranges but need to itemize deductions to receive this deduction

Analysis: Many teachers and coaches will benefit from this provision, but only if itemized deductions (such as mortgage interest, SALT, charitable contributions) exceed their standard deduction.

Biggest Losers #1: Current and prospective student loan borrowers

Provisions: (1) Borrowers on Saving on a Valuable Education Plan (SAVE) resumed accruing interest on 8/1/25; (2) SAVE, Pay As You Earn (PAYE), and Income-Contingent Repayment (ICR) plans will be eliminated by 7/18/28 and must move to existing Income-Based Repayment (IBR) plan or new Repayment Assistance Plan (RAP) before then; (3) new borrowers must choose between IBR or RAP plan starting 7/1/26; (4) forbearance and deferment options are limited to 9 months allowed within any 24-month period; (5) Graduate PLUS loan program is being eliminated; (6) graduate loans are capped at $100,000 for master’s degrees and $200,000 for professional degrees (law, medical, dental); (7) Parent PLUS loans are capped at $20,000 annually and $65,000 total per child

Analysis: The cumulative impact is quite negative for current and future student loan borrowers.

The immediate consequence is the resumption of interest accrual for borrowers enrolled in the SAVE program, introduced in 2023 with 7.7 million borrowers. Those in SAVE have remained in a forced administrative forbearance for more than one year. This suspended required monthly payments and set interest rates to 0%. The rate at which interest resumes accruing is based on borrowers’ loan promissory note, which could be anywhere from around 5% to over 8%. However, payments are not yet required and any voluntary payments will not count toward student loan forgiveness timelines until you switch to a new payment plan, as described next.

Existing student loan borrowers under SAVE, or the less popular PAYE or ICR plans, must switch to IBR or RAP plans by 7/1/28. Many observers believe the SAVE program will end sooner pending a court ruling. If no selection is made by 7/1/28, borrowers will be automatically moved to RAP.

The IBR plan was retained because unlike other income-driven repayment plans, it was created by Congress and is codified in statute. The downside of IBR is that it requires significantly higher monthly payments than SAVE. It features fixed payments over 10-25 years at 10-15% of discretionary income. The upshot is that payment is capped at the standard fixed 10-year plan payment, so high earners will not ever have to pay more than that. Further, switching to IBR retains forgiveness timelines of 25 years for pre-2014 loans and 20 years for post-2014 loans. The legislation also removed the requirement that borrowers have a partial financial hardship to qualify.

Meanwhile, the RAP plan has provisions that are on net, less favorable than the IBR plan for most borrowers. Foremost, it requires payments of 1-10% of AGI. Basing payments off this gross income figure is much more punitive than IBR’s use of the much lower discretionary income figure. RAP also requires $10/month payment, regardless of income. What’s more, it raises the amount of time borrowers need to make payments before they receive loan forgiveness to 30 years. There are several positive attributes of RAP plans, including (1) a protection that ensures the loan balance does not grow if the monthly payment does not cover the calculated interest; (2) up to $50/month of government-paid principal reduction; and (3) a $50/month per dependent deduction.

The bottom line for existing borrowers is that interest is now accruing again, the available go-forward repayment plans require greater monthly payments than the popular SAVE plan, and loan forgiveness takes longer under the RAP plan. Meanwhile, the Department of Education still has student loan forgiveness on pause under the IBR plan, with no timeline on when loan forgiveness processing will resume for the over 1.5 million IDR plans in backlog.

The changes are arguably worse for future student loan borrowers. New borrowers can choose among the IBR plan before 7/1/26, the RAP plan, and a revised “standard plan” which assigns a repayment window of 10-25 years depending on the size of debt, with equal monthly payments like a mortgage. The standard plan gives no opportunity for loan forgiveness.

Not only will undergraduate borrowers be limited to these less favorable plans relative to the SAVE plan, caps on graduate and parent PLUS loan amounts will push many borrowers into the private student loan market, which typically charges higher interest rates and requires creditworthy cosigners. Some prospective students will decide that because of these changes, going to college or graduate school just is not worth the time and expense.

Biggest Losers #2: People on Affordable Care Act (ACA) healthcare plans

Provisions: (1) Enhanced premium tax credits (aka subsidies) that were in effect from 2021-2025 expire; (2) all subsidies end when income reaches 400% of the federal poverty level (FPL) – previously premiums were capped at 8.5% of income for those earning >400% of FPL; (3) no cap on repayment of excess tax credits (when income ends up higher than expected at enrollment) -- previously there was a cap on repayments based on household income; (4) automatic re-enrollment ends – must reverify income each year to receive subsidies; (5) open enrollment period shortened to November 1 – December 15 (instead of January 15); (6) non-permanent-resident immigrants lose subsidy eligibility; (7) “Bronze” and “Catastrophic” options become HSA-eligible

Parameters: Effective in 2026 except for re-enrollment requirement that starts in 2028; permanent

Analysis: These changes will have a big impact on the average premium people pay. Removing the enhanced subsidies will make ACA coverage unaffordable for many, likely causing healthier enrollees to drop coverage. An expected sicker risk pool, on top of surging GLP-1 drug usage (to treat obesity and diabetes) and inflationary pressures, is leading insurers to request premium increases of around 15% for 2026. Those receiving subsidies, who make up more than 89% of the 21.4 million people enrolled in ACA plans in 2024, can expect premiums to surge over 75% on average largely because of the loss of enhanced subsidies that were in place the last five years.

The only positive change was making the Bronze and Catastrophic plans HSA-eligible. I recently wrote about the virtues of HSA accounts and how to optimize them over a lifetime.

Biggest Losers #3: Medicaid recipients

Provisions: (1) States must enforce monthly work or community engagement mandates of 80 hours for able-bodied adults ages 19-64 without dependents; (2) numerous other new barriers and funding reductions that will reduce Medicaid’s reach

Parameters: most changes go into effect in December 2026 or January 2027

Analysis: Certain low-income groups – namely older adults, rural populations, immigrants, and able-bodied working-age adults without dependents – will be adversely affected in some way. The Congressional Budget Office (CBO) has projected 7.8 million fewer people will be enrolled in Medicaid by 2034 (out of 78.4 million enrolled in April 2025) as a result of these policy changes. When including changes to the ACA marketplaces, the CBO estimates that 16 million more people will become uninsured by that time.

Biggest Losers #4: Frequent gamblers

Provision: Only 90% of gambling losses can be used to offset gambling winnings

Parameters: Effective 2026; permanent; previously 100% of gambling losses could be used to offset winnings

Analysis: This will sting frequent gamblers who are profitable or run near breakeven. As a result of this provision, it will be possible you will have to pay taxes during a year in which you were unprofitable at the casino or a sports betting app. For example, you could have $10,000 of gross winnings and $10,500 of gross losses, but because only 90% of losses ($9,450) are deductible, you would be taxed on $550 of net gambling “income”.

Biggest Losers #5: Future generations

Provision: Net effect of all the OBBBA provisions

Analysis: Most working people, especially those with medium-to-high income, benefit from generous tax cuts and extensions. However, that comes at a cost to younger generations who must shoulder rising budget deficits. The CBO estimates the bill will add $3.4 trillion to the primary deficit through 2034 via $1.1 trillion of decreased spending and $4.5 trillion of decreased revenue. With interest, it estimates the deficit increase will be $4.1 trillion. This comes on top of annual deficits that have remained stubbornly high since the onset of Covid-19 in 2020 (and reaching $1.8 trillion in 2024).

This level of deficit creation may prove unsustainable. Over the longer term, interest rates may feel upward pressure if investors demand a greater return to reflect higher credit risk, which could not only add to the country’s interest costs, but also increase individuals’ and businesses’ borrowing rates and pressure asset prices. Further, future members of Congress may feel pressured to take austerity measures to reverse the excesses by reducing spending and increasing taxes, hurting subsequent generations.

Slight to Moderate Losers #1: Charitable people

Provision 1: Charitable giving has a new 0.5% floor on AGI

Parameters: Effective in 2026; permanent; also introduces a 35% charitable giving deduction cap

Provision 2: Allowance for limited charitable contribution deduction without itemizing deductions

Parameters: Effective in 2026; permanent; deduction of up to $1,000 for single filers and $2,000 for MFJ; not subject to 0.5% floor on AGI; donation must be made in cash and cannot be made to “supporting organizations” or donor-advised funds

Analysis: These two provisions help one type and hurt other types of charitable givers. The group that benefits are those who make relatively small cash donations to qualifying charities who would otherwise not be able to take a tax deduction because their itemized deductions do not exceed their standard deduction.

The provisions hurt most other types of givers because the first 0.5% of giving based on one’s AGI (other than the limited allowed cash donations) does not qualify for a deduction. For example, someone with a $200,000 AGI would not be able to claim any deduction for up to $1,000 of only non-cash donations to an organization like Goodwill or Salvation Army. They also hurt people in the top 37% income tax bracket (estimated to be $635,985 single and $763,182 MFJ in 2026) because the deduction is limited to 35% versus 37% previously.

Slight to Moderate Losers #2: Future electric vehicle (EV) buyers

Provision: Eliminates EV credits that total $7,500 for new EVs and $4,000 for used EVs

Parameters: Effective 10/1/25; permanent; until then, vans, SUVs and pickup trucks $80,000 or less, sedans and passenger cars $55,000 or less, and used cars $25,000 or less qualify if it had final assembly in North America; new EV credit immediately phases out at $150,000 of MAGI for single filers and $300,000 of MAGI for MFJ; used EV credit immediately phases out at $75,000 of MAGI for single filers and $150,000 of MAGI for MFJ

Analysis: Prospective, qualifying EV buyers have less than two months left to take delivery of an EV to receive the generous tax credits. Prospective EV buyers who earn too much to qualify for the credit should wait for the credit to expire before purchasing because EV manufacturers and dealers will likely respond to reduced resultant EV demand with increased incentives.

Bottom Line

Although future tax policy under OBBBA does not look dramatically different than what has been in place since 2018, it is a stark change to how taxes and some spending would operate if the TCJA were allowed to expire at the end of 2025. The OBBBA retains tax favorability for middle- to upper-income and wealthy households, with added sweeteners for mortgage owners in high tax areas, seniors, tip collectors, overtime workers, young families, and educators. This arguably comes at the expense of future generations, with a broad swath of student loan borrowers, ACA healthcare plan customers, Medicaid recipients, and frequent gamblers about to feel the pain.

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a full spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This blog is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, tax, legal, insurance nor accounting services or an offer to sell or solicitation to buy insurance, securities, or related financial instruments in any jurisdiction. Certain information contained herein is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.