October 2025 Investment Letter

October 1, 2025

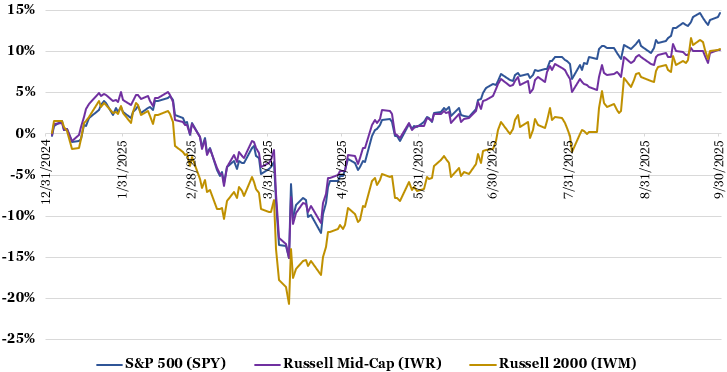

In the third quarter the stock market continued its march higher from what was a quick V-shaped recovery following the early April tariff-driven swoon. For the quarter, the S&P 500 (SPY) had a total return (including dividends) of 8.1%, the Russell Mid-Cap (IWR) rose 5.3%, and the small-cap Russell 2000 (IWM) surged 12.4%.

Figure 1: Stocks Rallied Further in the Third Quarter

Source: Koyfin (inclusive of dividends)

The third quarter received a mild boost from passage of the One Big Beautiful Bill Act (OBBBA) on July 4, to which I highlighted the winners and losers. Implications to large businesses were relatively modest, mostly coming from restoring 100% bonus deprecation that helps businesses write off capital expenditures for tax purposes more aggressively. The impact on individuals and small business owners was more impactful, which made permanent the lower personal income tax rates that were set to expire in 2026 and lower taxability further for much of the upper-middle to high income households who hold the vast majority of stock market wealth.

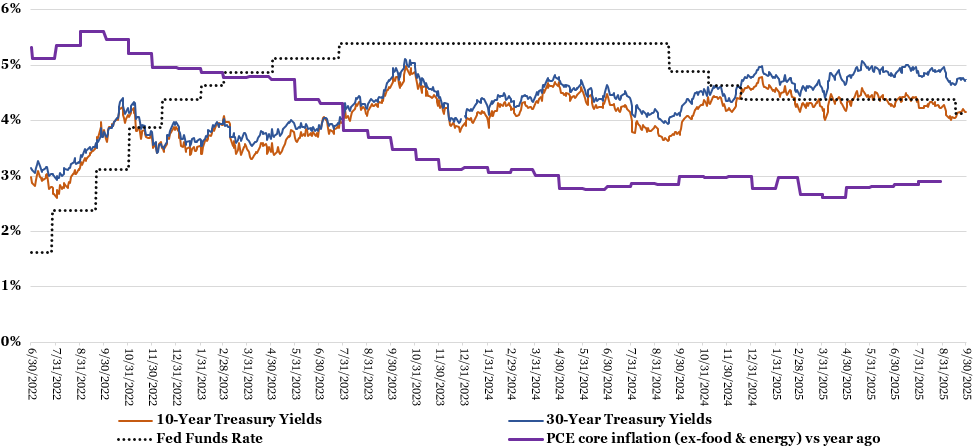

Another major theme in the third quarter was anticipation and realization of a resumption in Federal Reserve rate cuts. On September 17th, the Federal Reserve cut its benchmark Fed funds rate by 25 basis points (0.25%) to 4%-4.25%, its first rate cut since December 2024. The median expectation among the 19-member Federal Open Market Committee (FOMC) projects two more 25 basis points cuts in 2025, one cut in 2026, and one cut in 2027 (to 3-3.25%), though the projections are more wide ranging than normal.

A renewed cycle of Fed cutting in an economy that continues to hold up despite tariff pressures has given a green light to risk taking. The most aggressive growth and speculative stocks that in many cases earn little to no profits have appreciated the most. Much of the investor excitement has centered around artificial intelligence (AI) and cryptocurrency ecosystems. High investor fervor has led to a dramatic rise in the number of initial public offerings (IPOs) and special purpose acquisition vehicles (SPACs) coming to market to cash in. These areas of the market are beginning to feel frothy.

Market Outlook

Much of the stock market rally is reliant on continued excitement surrounding AI. Of the 10 largest companies in the S&P 500 that together make up 40% of the market value, eight are widely viewed as major AI beneficiaries.

All signs point to AI having a profound impact on the global economy with heavy AI investments by companies as table stakes to thwart disintermediation, gain cost efficiencies, and/or generate greater revenue. I expect all the hyperscalers to signal sharply higher levels of AI-related capital expenditures in 2026 when they report earnings results in the coming weeks, dispelling fears early in the year that 2025 could mark a cyclical spending peak. In a note published September 30, Citigroup raised its forecast for AI-related infrastructure spending by tech giants to surpass $2.8 trillion through 2029, from $2.3 trillion estimated earlier.

It is probably too early to overly fret, but there will be a time when AI-related spending contracts, if only temporarily, when anticipated benefits do not meet expectations or the willingness or ability to spend ever greater sums wanes. When this happens, market capitalization-weighted indexes like the S&P 500 could come under serious pressure given the significant weighting to AI plays. Having a diversified portfolio that is not overly reliant on one theme should help cushion any blow.

Two other large, identifiable risk factors to an otherwise favorable market backdrop are the economy and long-term interest rates. Recent economic data and company earnings reports point to a tale of two consumers – the well-off who own stocks, a home, and a stable job, and those who do not. Spending trends between the two cohorts ought to continue, with consumers as a whole keeping the economy in expansion mode assuming layoffs remain contained and the unemployment rate stays in the 4s (currently 4.3%). The employment situation bears watching though.

If longer-term U.S. Treasury yields rise, that could also pressure the market. Yes, short-term interest rates are likely to fall further, especially considering President Trump will be nominating a new Fed chair to start in May who is likely to be more amenable to lower rates (despite inflation persisting well above the Fed’s 2% target). However, long-term rates can move opposite to short-term interest rates if there is a growing belief that the Fed cares more about economic growth than suppressing inflation. This matters to markets because when long-term interest rates rise, companies cannot lock in low-interest rate debt, bonds become more competitive with stocks, and companies’ future earnings are worth less today using present value calculations.

Figure 2: Fed Resumes Cuts Amid 3% Inflation but Longer-Term Yields Haven’t Fallen Much

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System. https://fred.stlouisfed.org/series/DGS10 (10-year US Treasury yield). https://fred.stlouisfed.org/series/DGS30 (30-year US Treasury yield) https://fred.stlouisfed.org/series/PCEPILFE (PCE inflation ex-food & energy). Forbes Advisor. https://www.forbes.com/advisor/investing/fed-funds-rate-history/ (Fed Funds rate).

Notably, I do not believe there will be any lasting economic or stock market impact from the current government shutdown.

I have said this many times before and will say it again -- no matter the economic, monetary, political, or geopolitical environment, it is critical to not try to time the market and stay true to a long-term asset allocation that makes sense given your return objective, risk tolerance, and time horizon. The markets have a way of both surprising us all and generating healthy returns over time.

Client Positioning

I take a long-term view that focuses on compounding returns in a tax-efficient manner. I allocate the bulk of my clients’ equity exposure to “quality growth” companies that possess durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. I generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate my investment thesis and retaining stocks of companies with solid fundamentals. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

Portfolio activity was relatively heavy in the third quarter. I continued to fine tune our holdings levered to AI infrastructure. I sought consistent exposure to this dynamic theme while managing individual company risk. The other notable change across clients accounts was the sell off of Eli Lilly (LLY), with about half the proceeds deployed into additional shares of Steris (STE), which I recently wrote up, and the other half used to top off positions in several other holdings (see below).

Figure 3: Portfolio Changes in Majority of Client Accounts in 3Q 2025

Source: Glass Lake Wealth Management

Although the AI infrastructure theme is alive and well, I do not want to overly expose clients to risks that the AI trade falters. Therefore, I will likely make selective trims of related stocks into further share price strength. Nvidia (NVDA), a company I started to trim last quarter and remains among our largest holdings, is likely to be a name I continue to pare back if it continues to make new highs, especially in non-taxable accounts.

As always, you can expect me to abstain from stocks in long-term challenged industries, such as traditional energy, airlines, and autos. I will also continue to avoid the most speculative areas of the market such as unprofitable “story” stocks, recent special purpose acquisition companies (SPACs) and pump-and-dump meme stocks. The most speculative stocks have had a banner year thus far, but I intend to stay disciplined and not chase them higher.

For clients’ fixed income portfolios, I continue to overweight low duration holdings (duration is a measure of a bond price’s sensitivity to changes in interest rates) such as short-term Treasuries and short-term corporate bonds. I do not believe long-term yields adequately reflect the United States’ fiscal situation and future monetary policy risks. As a reminder, bond prices fall when yields rise.

Overall asset allocation is likely to remain near current levels unless there is a big move in either direction in the stock or bond markets. I will seek to take advantage of any big stock market correction by increasing clients’ stock exposure if the ability and willingness to take more risk is there. On the flipside, if the stock market is feeling especially frothy and bond yields look relatively attractive, I may look to increase client’s fixed income allocation.

Have a happy, healthy, and wealthy fall season!

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.