January 2026 Investment Letter

January 5, 2026

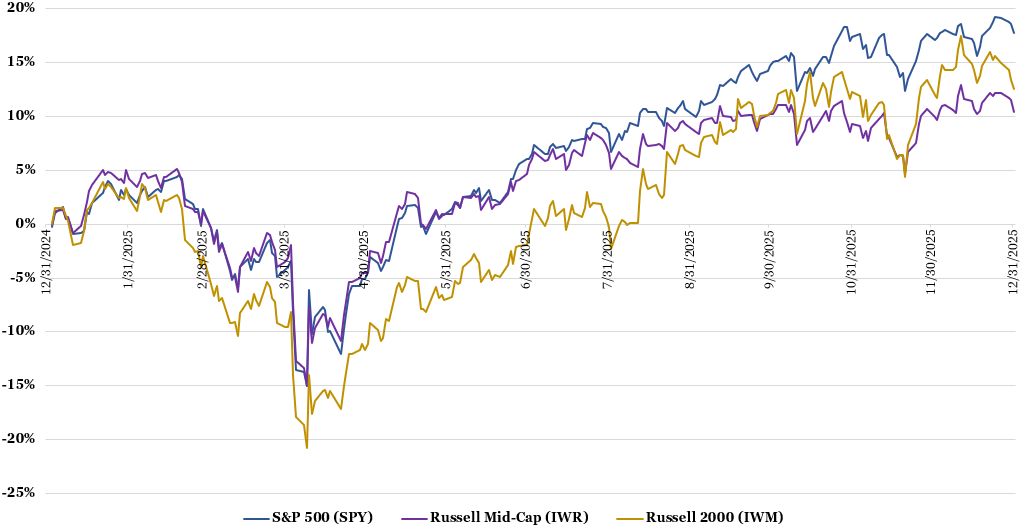

In the fourth quarter the stock market continued its climb higher from what was a quick V-shaped recovery following the early April tariff-driven swoon. For the quarter, total returns (including dividends) were 3.0% for large capitalization stocks (as represented by the S&P 500 ETF SPY), 0.5% for mid caps (as represented by the Russell Mid-Cap ETF IWR), and 2.4% for small caps (as represented by the Russell 2000 ETF IWM). This brought 2025 returns to 17.7%, 10.4%, and 12.6%, respectively, a third consecutive year of double-digit market returns.

Figure 1: Stocks Edge Higher in Fourth Quarter, Capping Off Another Strong Year

Source: Koyfin (inclusive of dividends)

Sector strength was broad-based in 2025. The biggest winners were tied to artificial intelligence (AI) spending in some capacity, such as Nvidia (NVDA; owned and up 39%), Alphabet (GOOG; owned and up 66%), Broadcom (AVGO; up 59%), and Micron Technology (MU; up 239%). Large money center banks and investment banks also did particularly well given the reduced regulatory scrutiny, steeper yield curve, and increased capital markets activity. The biggest areas of underperformance came from consumer cyclical industries like apparel and restaurants, consumer staples, and software companies.

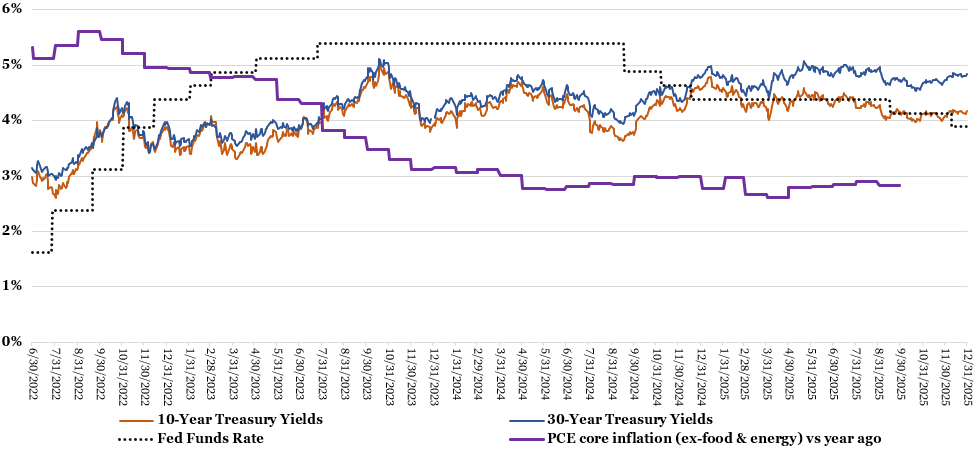

The stock market has overcome headwinds like tariff-induced price inflation, a weakening labor market, and persistent geopolitical tensions for a variety of factors. The first is a dovish Federal Reserve. On December 10th, the Fed cut its benchmark Fed funds rate by another 25 basis points (0.25%) to 3.75%-4%. A soon-to-be-chosen new Fed chair by President Trump ought to cut rates further given Trump’s repeated criticism of current Fed Chair Jerome Powell, whose term expires in May, for not cutting rates much more aggressively. At least in the short term, lower interest rates help to stimulate faster economic growth and boost stock prices, especially of faster growth and more speculative companies.

Figure 2: Fed Cuts Again but Longer Term Rates Hold Steady

Sources: St. Louis Fed/Board of Governors of the Federal Reserve System. https://fred.stlouisfed.org/series/DGS10 (10-year US Treasury yield). https://fred.stlouisfed.org/series/DGS30 (30-year US Treasury yield) https://fred.stlouisfed.org/series/PCEPILFE (PCE inflation ex-food & energy). Forbes Advisor. https://www.forbes.com/advisor/investing/fed-funds-rate-history/ (Fed Funds rate).

The stock market has also been supported by a resilient economy, albeit an increasingly K-shaped one. Those who have stable, good paying jobs, bought their home before interest rates spiked, and own stocks are doing particularly well. Meanwhile, those new to the workforce, student debt holders, first home seekers, and the uninvested are generally struggling with a weakening job hiring environment, resumed student debt payments, persistently unaffordable home prices, and high consumer prices.

The former is more than making up for the latter, with overall real (inflation adjusted) GDP growth at a robust 4.3% in the third quarter. The large bifurcation is likely to persist as effects from the passage of the One Big Beautiful Bill Act (OBBBA) on July 4 become more fully felt. In previous blogs, I highlighted the winners and losers and identified financial planning opportunities resulting from the legislation. Within I concluded that the biggest beneficiaries are upper-middle to high income households who hold the vast majority of stock market wealth.

A third major driving force for the stock market strength is ongoing excitement surrounding AI. I believe the economy is very much in the early innings of being transformed. These first few years of transformation require substantial AI infrastructure investment, which directly benefits a large swath of industries, such as cloud hyperscalers, semiconductors, tech hardware, utility and energy providers, and industrials that operate in, or connect to, data centers. Notwithstanding some customer funding issues (most notably OpenAI, the owner of ChatGPT), all signs point to the massive investment cycle continuing into at least 2027.

I believe we are beginning to see tangible AI-driven improvements in the real economy, creating distinctive winners and losers. The winners are a broad swath of companies that can accomplish more with fewer people, ultimately supporting higher profit margins and greater stock prices. Indeed, the number of large companies that have indicated they will maintain or cut headcount despite healthy growth has risen dramatically. Although this is great for shareholders, prospective job seekers are having a tougher time, especially those seeking entry level positions that are more at risk of being automated by AI.

Big picture, AI should create large productivity improvements that can allow for greater levels of economic growth without inducing inflation, akin to the productivity improvements spearheaded by the internet in the late 1990s. This is perhaps the largest driving force for the economy and stock market over the next five-plus years.

Market Outlook

Much of the stock market is reliant on the current AI infrastructure supercycle. Of the 10 largest companies in the S&P 500 that together make up 40% of the market value, eight are widely viewed as major AI beneficiaries. So, in some respects, as sentiment around AI infrastructure spending oscillates between greed and fear, so does performance of market capitalization-weighted market indexes. Although I believe it is too early to overly fret, there will be a time when AI-related spending contracts, if only temporarily, when anticipated benefits do not meet expectations or the willingness or ability to spend ever greater sums wanes.

Besides a bursting of a plausible AI bubble, a big risk to the market is the weakening labor market. The unemployment rate rose to 4.6% in November, up from 4.4% in September (no data for October given the government shutdown) and the 4.0%-4.2% range from May 2024 to July 2025. An employment rate rise to above 5% has the potential to tilt the economy into a long-feared recession. Other notable risks include inflation reaccelerating if the Fed cuts rate too aggressively and the seemingly inevitable but unknown timing of China seeking to take over Taiwan.

Worth mentioning is that 2026 is a midterm election year. These years have historically been the worst of the presidential cycle, with the S&P 500 finishing the year higher just 53% of the time with an average gain of 4.6%, with the other three years finishing up 78% of the time, with an average gain of 11%. It is possible that much of the market-friendly tax and regulatory changes by the current administration has already been priced into the stock market over the past couple of years, leading to below average returns this year.

I believe that the bullish forces from an increasingly accommodative Fed, continued strong spending among the well-heeled, and AI’s positive growth and deflationary effects will win out, ultimately driving a fourth consecutive year of double-digit market returns, though with above average volatility. This is merely speculation, however, given how hard it is to accurately predict broad market moves.

As I have said many times before, it is next to impossible to consistently time the stock market in a profitable manner. I remain steadfast in my belief that people are best served in staying true to a long-term asset allocation that makes sense given their return objective, risk tolerance, and time horizon. The markets have a way of defying the consensus view while generating healthy returns over time.

Client Positioning

I take a long-term view that focuses on compounding returns in a tax-efficient manner. I allocate the bulk of my clients’ equity exposure to “quality growth” companies that possess durable competitive advantages, above-average long-term growth prospects, high levels of profitability and free cash flows, and prudent levels of debt. I generally take a “pruning the weeds and nurturing the flowers” approach of selling stocks that violate my investment thesis and retaining stocks of companies with solid fundamentals. I believe this investment philosophy affords my clients the best shot of generating maximum after-tax, risk-adjusted returns compounded over the long run.

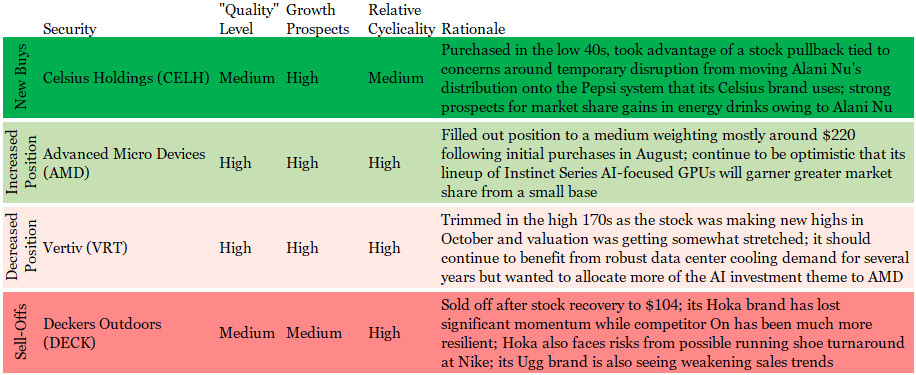

Portfolio activity was on the light side in the fourth quarter. The biggest move was swapping Deckers Outdoors (DECK) for Celsius Holdings (CELH). Both are consumer companies, but their operating trajectories are divergent. Whereas Deckers is experiencing weakening “brand heat” of its Hoka brand within the premium running shoe category, Celsius is seeing strengthening underlying sales trends in the energy drink category with its namesake brand and Alani Nu, acquired in April at a valuation that is proving to be very favorable.

I continue to fine tune client holdings within the AI infrastructure supercycle. The overall strategy remains to trim into notable stock price strength – like Vertiv (VRT) this past quarter -- and redeploy into exposed names that are seeing a positive fundamental inflection – like AMD (AMD) this past quarter.

Figure 3: Portfolio Changes in Majority of Client Accounts in 4Q 2025

Source: Glass Lake Wealth Management

As always, you can expect me to abstain from stocks in long-term challenged industries, such as traditional energy, airlines, and autos. I will also continue to avoid the most speculative areas of the market such as unprofitable “story” stocks, recent special purpose acquisition companies (SPACs) and pump-and-dump meme stocks.

For clients’ fixed income portfolios, I have begun to shift to more medium duration holdings (duration is a measure of a bond price’s sensitivity to changes in interest rates) from mostly low duration holdings. With the Fed’s recent Fed Funds rate cuts, short-term bonds are yielding less. A steepening yield curve augurs for going further out in the curve to achieve better yields, but not so much that we risk material bond price declines (bond prices decline as yields rise). I continue to abstain from high duration bonds because I do not believe long-term Treasury yields adequately reflect the United States’ fiscal situation and monetary policy risks from an overly accommodate future Fed chair.

Overall asset allocation is likely to remain near current levels unless there is a big move in either direction in the stock or bond markets. I will seek to take advantage of any big stock market correction by increasing clients’ stock exposure if the ability and willingness to take more risk is there. On the flipside, if the stock market is feeling especially frothy and bond yields look relatively attractive, I may look to increase client’s fixed income allocation.

Have a happy, healthy, and wealthy start to the new year!

Sincerely,

Jim Krapfel, CFA, CFP

Founder/President

Glass Lake Wealth Management, LLC

glasslakewealth.com

608-347-5558

Disclaimer

Advisory services are offered by Glass Lake Wealth Management LLC, a Registered Investment Advisor in Illinois and North Carolina. Glass Lake is an investments-oriented boutique that offers a wide spectrum of wealth management advice. Visit glasslakewealth.com for more information.

This investment letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Glass Lake has no duty or obligation to update the information contained herein. Further, Glass Lake makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, whenever there is the potential for profit there is also the possibility of loss.

This investment letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory, legal, or accounting services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends or market statistics is based on or derived from information provided by independent third-party sources. Glass Lake Wealth Management believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions in which such information is based.